Wall Street just had its worst week since April, and it all started with a single number.

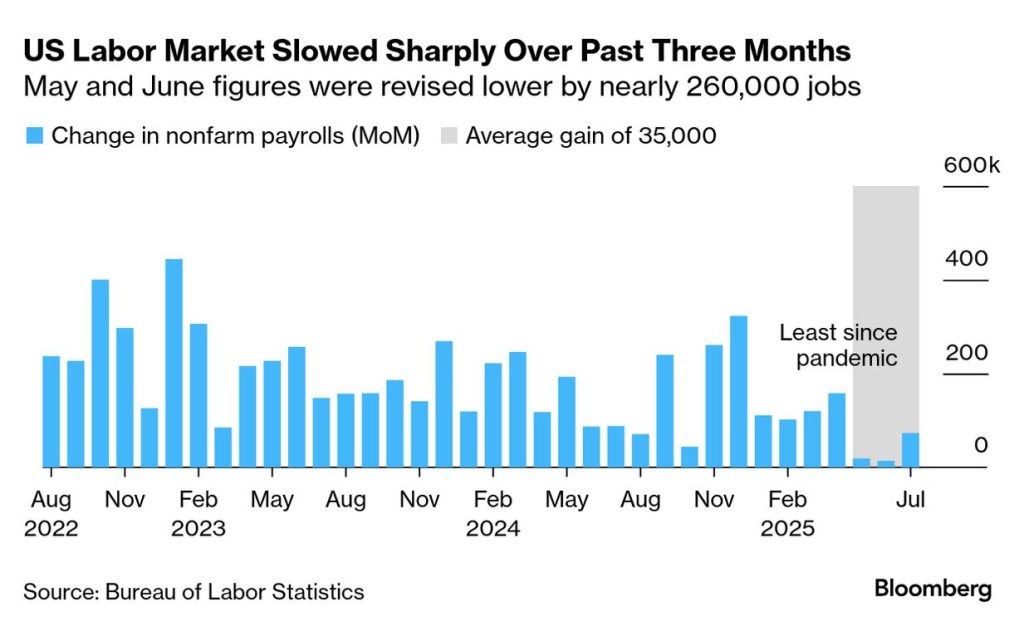

In July, the US economy added only 73,000 jobs, falling well short of the 100,000 expected. The shock didn’t stop there – previous job growth estimates for May and June were sharply revised down by a combined 258,000.

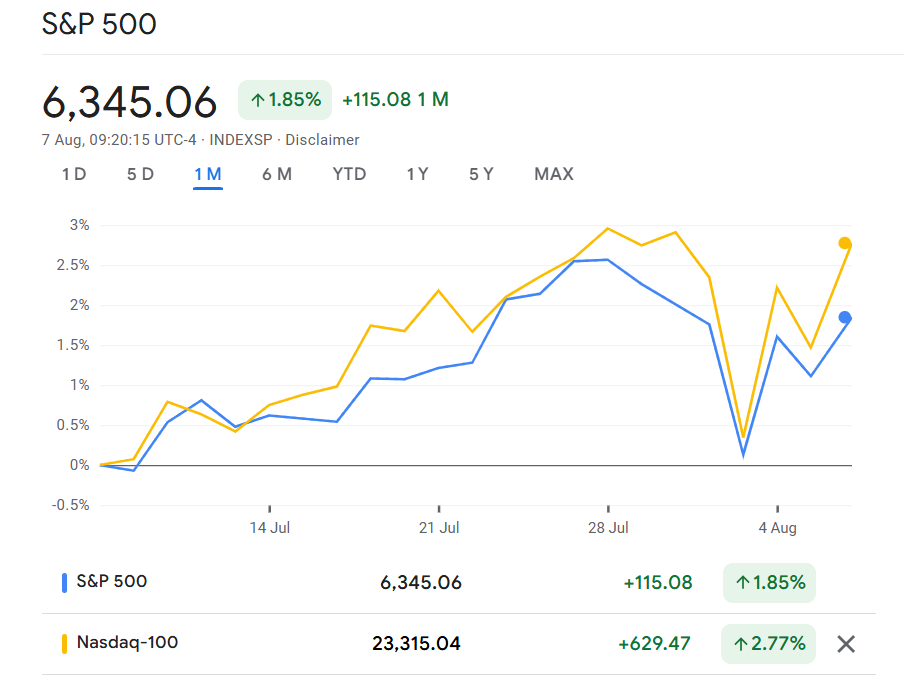

Almost immediately, markets reacted. The S&P 500 fell by 2.4% for the week, while the Nasdaq dropped 2.2%, as investors reassessed expectations for the US economy and upcoming interest rate decisions.

For many traders, economic data like the monthly jobs report might seem like background noise. But in reality, these numbers play a powerful role in shaping market sentiment, driving price moves, and even guiding central bank decisions.

What is the jobs report – and why should traders care?

The US jobs report, officially known as the Nonfarm Payrolls (NFP) report, is published monthly by the US Bureau of Labour Statistics.

It provides a detailed snapshot of how many jobs were created or lost across the economy (excluding farm work, government jobs, and a few other categories). Alongside job creation, it includes data on the unemployment rate, labour force participation, and wage growth.

Why is this report so closely watched by traders? Because employment levels directly reflect the health of the economy. More jobs typically mean more consumer spending, business growth, and stronger corporate earnings – all of which support rising stock prices.

On the other hand, weak job numbers may signal slowing economic activity, putting pressure on earnings and increasing the risk of recession.

The jobs report also influences central bank policy. If the labour market is weakening, the Federal Reserve may feel more pressure to cut interest rates to support growth.

July’s shocking numbers: What happened?

July’s report took the markets by surprise. Only 73,000 new jobs were added – far fewer than the 100,000 forecast by economists. Even more concerning were the revisions to earlier months: May and June’s numbers were reduced by a combined 258,000 jobs.

This downward adjustment indicates the slowdown didn’t just begin in July – it’s part of a broader trend that’s been underestimated.

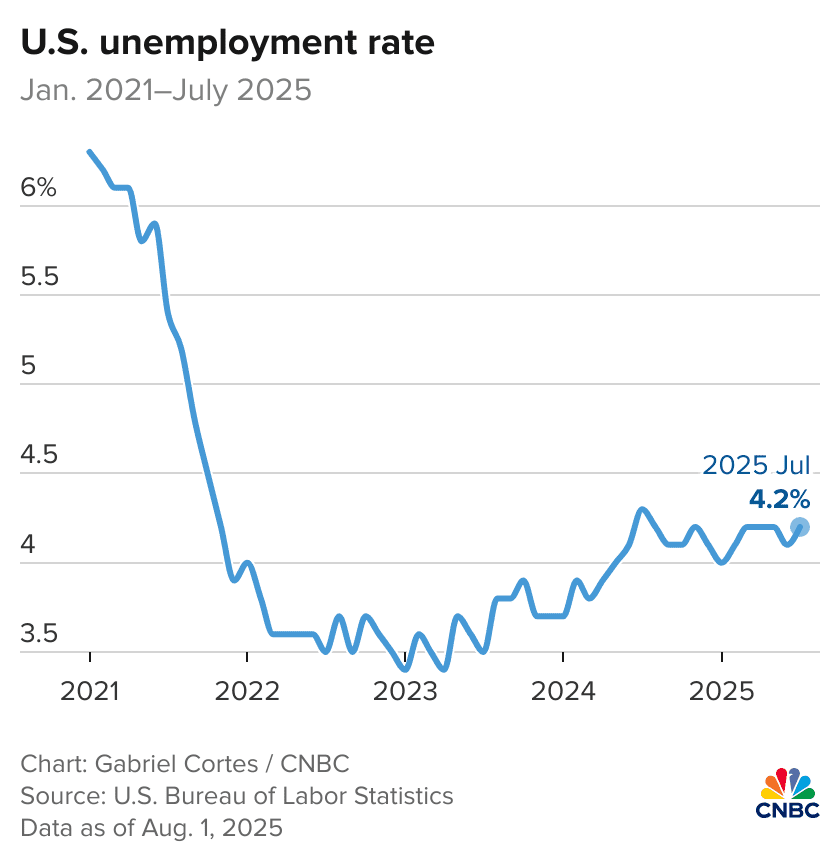

The unemployment rate also ticked up slightly to 4.2%, and wage growth remained subdued. These signs suggest that the labour market – previously one of the US economy’s strongest points – may now be cooling more rapidly than expected.

As a result, traders swiftly recalibrated their expectations for monetary policy. Before the report, the odds of a Federal Reserve rate cut in September were around 40%. After the release, that probability surged to over 90%.

How job reports affect the financial markets

The jobs report is one of the most market-moving economic releases in the financial calendar. Here’s how different markets typically respond:

Stock markets (such as the S&P 500 or Nasdaq) often rally on strong jobs data, as it signals economic growth. But they can fall sharply if the data suggests weakness or raises fears of stagflation. July’s weak report led to the worst weekly stock market performance since April.

Currency markets, particularly the USD, react quickly to job figures. Strong job growth tends to strengthen the dollar, while weak numbers, like in July, cause the dollar to drop as rate cut expectations rise.

Bond markets see immediate shifts. Weak jobs data typically pushes bond prices up and yields down, as investors bet on lower interest rates.

Commodity markets, such as gold and oil, also respond. Gold often rises on economic uncertainty and expectations of lower interest rates, while oil may fall if traders anticipate reduced demand from a slowing economy.

The key point? A single number in a jobs report can trigger widespread volatility across all major markets.

Why unemployment isn’t just a statistic

The unemployment rate is more than just a number – it reflects real-world economic momentum. When unemployment rises, it can lead to reduced consumer spending, slower growth, and weaker investor confidence.

For traders, rising unemployment often signals riskier conditions for businesses and can impact sectors differently.

For example, consumer discretionary stocks (such as retail and travel) tend to be more sensitive to unemployment data than defensive sectors like utilities or healthcare.

Similarly, currencies of countries with rising joblessness can come under pressure, as weaker economies attract less investment.

Think of unemployment as an early warning system. It often rises before other indicators of economic trouble show up in earnings reports or GDP figures. That’s why traders monitor it so closely.

What traders should watch next

With July’s report sending shockwaves through the markets, what should traders be paying attention to in the coming weeks?

- Upcoming Fed meetings: Will the central bank confirm a September rate cut?

- Wage growth data: Weak wage gains can reinforce rate cut expectations.

- Consumer spending figures: If people stop spending, the slowdown may deepen.

- Corporate earnings: Especially from job-sensitive sectors like retail and hospitality.

- Other economic indicators: Watch for confirmation in inflation, GDP, and housing data.

- Market sentiment: Reactions from institutional investors often shape price trends.

These elements can help traders understand where markets might move next – and how to prepare for volatility or opportunity.

Conclusion

The July jobs report was a wake-up call for traders. It reminded the markets that even one economic indicator can shake expectations, shift central bank policy bets, and trigger widespread volatility.

For traders, it’s important not to get lost in the noise. Focus on understanding why the market moves, not just how. Keep an eye on key indicators like jobs data, but also maintain a broader view of macroeconomic trends and central bank signals.

Most importantly, use this as an opportunity to prepare. Volatility can bring risk, but also opportunity – if you are ready for it.

Want to take advantage of market moves with confidence? Open a live account with VT Markets today and gain access to real-time data, fast execution, and a powerful trading platform to help you trade smarter.